1. Convenience

Using a credit card makes purchases easy for a credit cardholder even if he has no cash on him at the present time. It enables the individual to have the opportunity of enjoying conveniences as if he was paying for the goods or services at that present time. A credit card also enriches the standard of living of cardholder who thinks he is unable to afford some things based on his current pocket structure. The credit card also allows an individual to withdraw cash from his credit limit and is expected to pay back at the end of the month. Thus, using a credit card is convenient in its function and its usage by the cardholder.

2. Keeps records of your purchases

The use of a credit card helps the cardholder to keep tracks of past transactions he had made using the credit card. Imagine you are using a debit card and you are charged for the services you do not know about, if at the end of the day you report the case to your bank, it may take time for the transaction that took place to be detected. But as for a credit card, since the credit card issuer was involved in the transactions, it is always easy for the credit card issuer to provide the statement of past transactions that have taken place. It also helps in the reconciliation of transactions done with the credit card and the refunding of the loans by the cardholder.

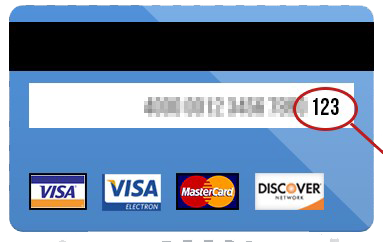

3. Financial Security

The use of credit card prevents the cardholder from fraudulent or unexpected expenses and transactions. Assuming you made a transaction online and you discovered that its bounces after you might have paid, the credit card issuer will make checks and balances on your behave because by using a credit card, you only pay for the services or goods you enjoyed.

4. Cash efficiency and value for your money

Using a credit card indicates that you only pay for the value of goods or services you enjoyed. Consumer’s utility has been a means of determining cash efficiency is guaranteed using a credit card.

5. Grace period

A grace period of one month is given for the repayment of credit card debt to the issuer, after which the issuer's charges interests based on the agreement between the two parties (the cardholder and the credit issuer)

6. Insurance

Ordinarily, most credit cards come with the abundance of protections for the consumers that even they don’t know, some of those insurances are travel insurance, product warranties and rental car acceptance insurance.

7. Global

The credit card in view of upholding the cashless policy going on around the world, it helps individuals to carry as much money as the can in their pocket or wallet. The credit card could be used anywhere in the world to purchase things, a book for flight, restaurants etc.